What is Community-Minded Personal Finance?

This post is the first in a series of articles I plan to share on the topic of community-minded personal finance. My goal with this piece is to clarify what I mean by "community-minded personal finance" and describe what I see as some of its key characteristics. After reading this article, my hope is that you will know whether or not community-minded personal finance is something you are interested in seeking out. If it is, you will also have some guideposts to help you know when you've found it.

I mentioned in my first article for this newsletter that a key theme I will be exploring is how we can work against the "gravitational pull" of Most of Finance and move towards a better kind of finance (what I referred to as TBD Finance). I attempted to show that one aspect of this work is about the values and worldviews in our minds and in the minds of finance professionals. Engaging at the level of values and worldviews may seem like a daunting task, but I also find it hopeful because I genuinely believe most people already do not hold the values that dominate our finance systems today. It’s just that most people are not “finance people.”

But, even if you identify as “not a finance person,” the truth is that you will still interact with finance systems consistently throughout your life (whether consciously or not). We typically call the field where our everyday lives bump up with the financial world, “personal finance.” I believe that figuring out how to approach our personal finance decisions in a way that reflects our values and worldviews can not only make us feel better personally, but can also play a part in nudging our economy in a better direction.

You may be asking, is there such a thing as an approach to personal finance that takes a TBD Finance perspective? Is there a way to do personal finance that considers collective wellbeing and is not locked in by outdated economic logic? Yes! Yes, there is!

I call it: community-minded personal finance. And the good news is that there are a lot of people, organizations, and resources out there in this area.

It’s just that the field of personal finance is so weird and noisy that it can be hard to find these people, organizations, and resources unless you are clear on what you are looking for.

For this reason, this article seeks to clarify what I think "community-minded personal finance" is and give you some suggestions for how you can identify it when you see it.

First, What is Personal Finance?

To start, let’s make sure we're on the same page about what "personal finance" means - leaving out the "community-minded" part for a moment.

Stated simply, I'd describe "personal finance" as how you manage financial things directly under your control.

Here’s how Investopedia defines personal finance:

“Personal finance is about meeting your financial goals and understanding all the routes to do this, from saving and investing, and keeping debt under control, to buying a home to planning for retirement—and coming up with a plan to accomplish these goals. It’s also the name of the industry that provides financial products to meet these goals.”

Despite my qualms with many definitions on Investopedia (more on that below), I generally agree with the above definition of personal finance. Let's use that as our starting point.

Ok, So What is Community-Minded Personal Finance?

What, then, do I mean by “community-minded personal finance”?

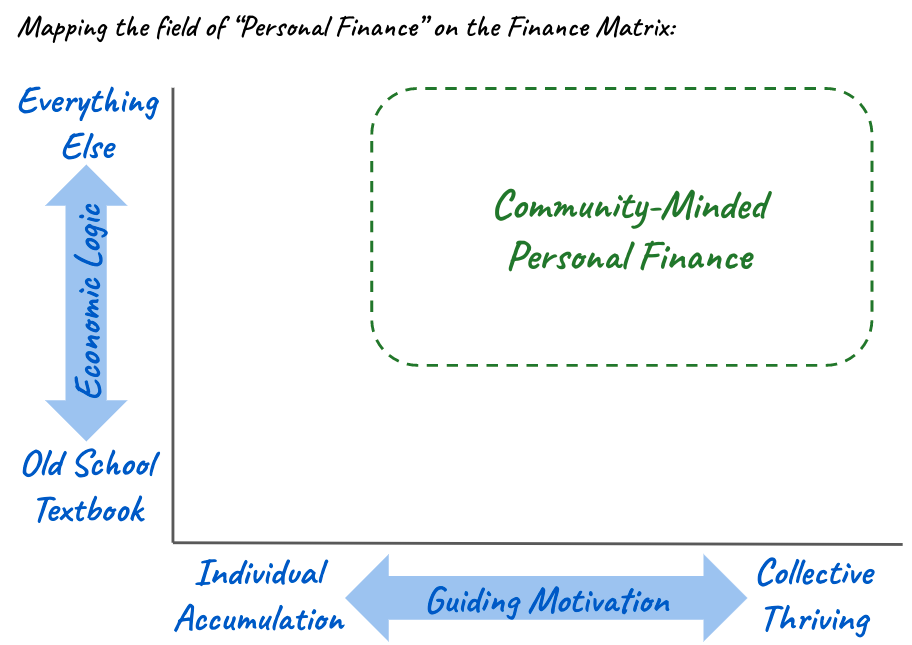

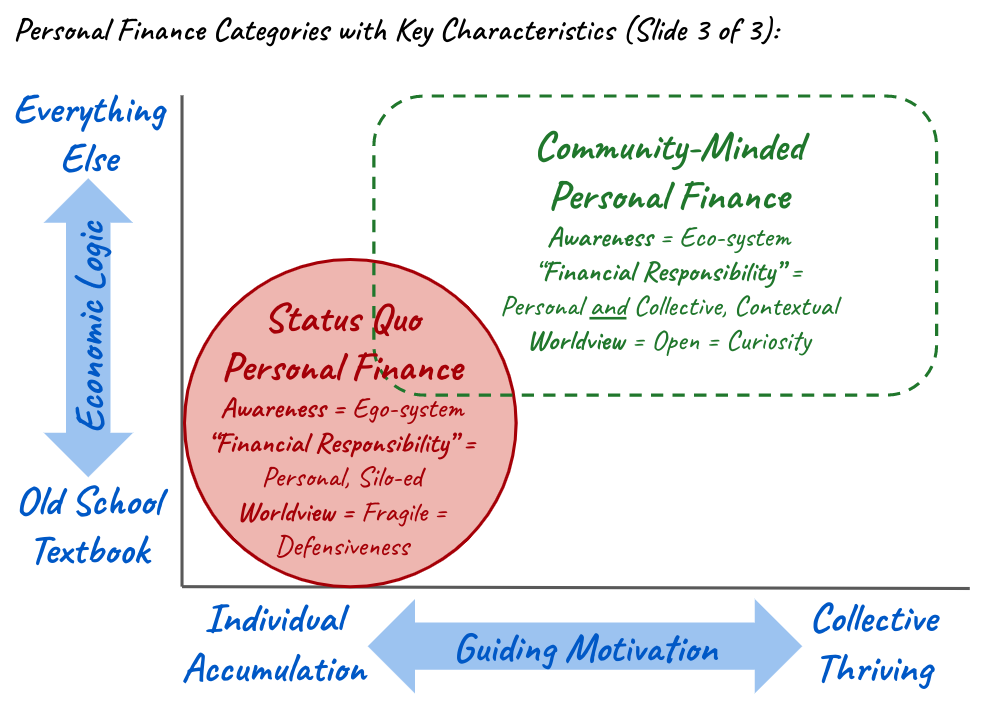

Here’s how I see it. If we were to map the field of personal finance onto the finance matrix I introduced previously, community-minded personal finance would cover the top right area like this:

As the matrix drawing suggests, I see community-minded personal finance as the type of personal finance you practice if: 1) you are motivated by goals that are more collectively-oriented than individual accumulation alone; and 2) you believe the way the world works is not fully captured by old school textbook economic assumptions.

What is Status Quo Personal Finance?

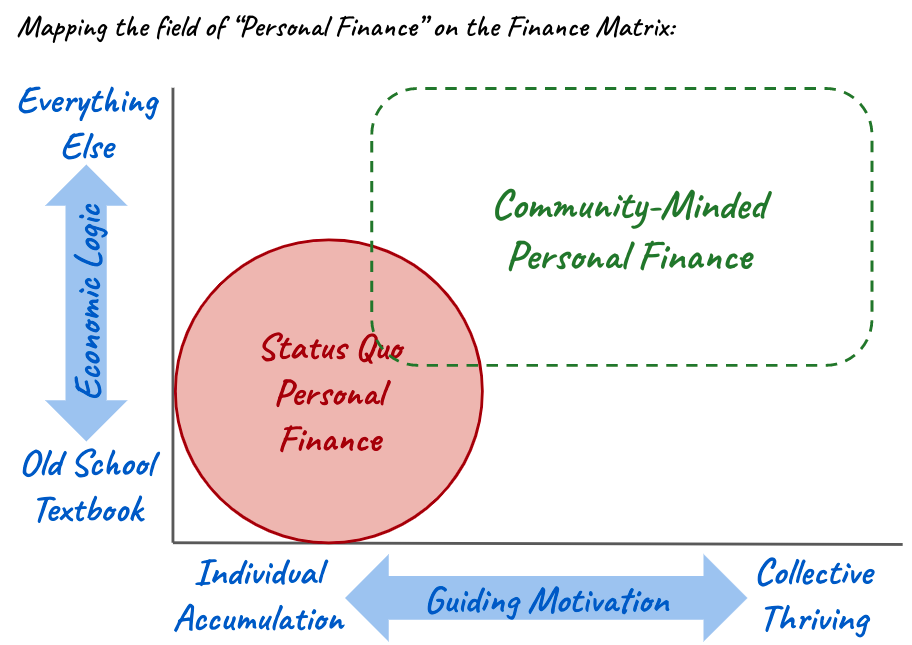

To understand community-minded personal finance, we also need to distinguish it from what it is not. It is not the type of personal finance that is defined by the bottom left corner of this matrix, what I call “status quo personal finance.”

I define status quo personal finance as any personal finance advice, product, service, perspective, etc that: 1) assumes individual accumulation is the dominant guiding motivation; and 2) is bounded by old-school textbook economic logic.

I’m calling this bubble “status quo" because a central assumption here is that any larger societal systems that impact individual personal finance decisions are fixed. In the status quo personal finance space, societal systems and structures - if they are acknowledged at all - are treated as something to be navigated by "prudent" personal financial planning and behavior. Specifically, the perspective here is that personal finance, as a field, is NOT a place where we talk about politics or systemic change.

Now, I recognize that the definitions I've suggested above are still kind of abstract and rely on some familiarity with what I'm calling "old school textbook economic logic" (which is a rabbit hole that I don't want to digress into here, but feel free to check out these resources for more on that topic).

So, let me now offer some additional characteristics that I think can help us further distinguish what is, and what isn't, community-minded personal finance.

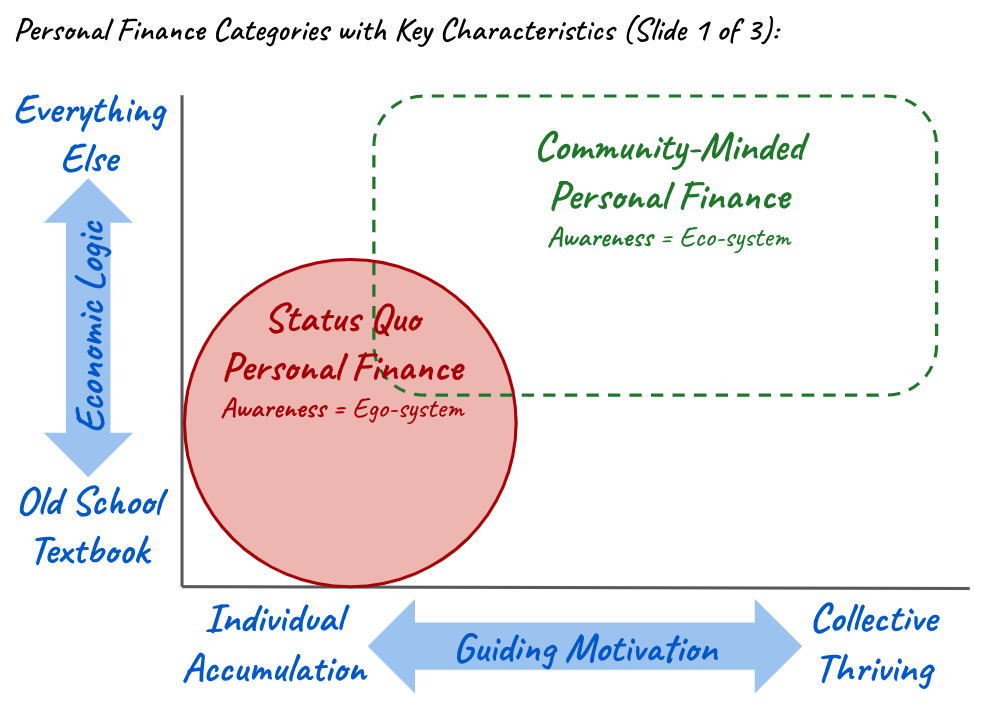

Ego-system vs. Eco-system Awareness

Otto Scharmer and colleagues at MIT have developed a global capacity-building platform called the U-School that focuses on the process of “updating our operating systems” from “ego-system thinking” to “eco-system thinking.” I recommend checking out Scharmer and Katrin Kaufer's book, Leading from the Emerging Future (free chapter downloads here), and the many courses and tools on the U-School site for more on this topic.

In the U-School overview of ego-to-eco thinking, they state:

“Meeting the challenges of this century requires updating our operating system from an obsolete “ego-system” focused entirely on the wellbeing of oneself to an eco-system awareness that emphasizes the wellbeing of the whole.”

Scharmer and colleagues show how our operating systems - the systems that shape our very consciousness - are deeply impacted by the focus of our awareness.

In the context of personal finance, we can understand status quo personal finance as that which is based on what Scharmer would call an “ego-system" operating system, where awareness is focused only on the wellbeing of "the self." Community-minded personal finance, on the other hand, is compatible with what Sharmer would call an "eco-system" operating system, where awareness is focused on the complex, interdependent ecosystems that impact the wellbeing of both "the self" and "the whole."

I like the U-School approach because they have a number of models and frameworks that give structure to the esoteric (but I think accurate!) idea that systemic change work requires “shifting our paradigms of thought and consciousness.” They also make clear how this work is both a very collective and a very personal process (in many ways, that is the whole focus of the U-School as I understand it, so if you're into this kind of thing, let me again recommend exploring their site for more resources).

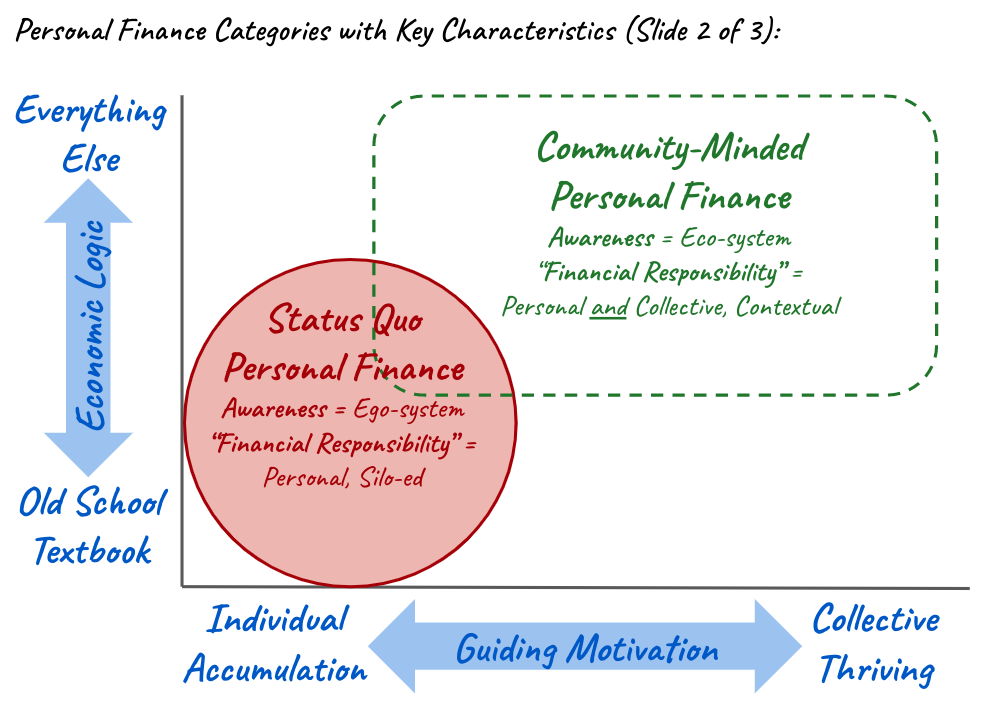

Sometimes the underlying operating system behind personal finance information or entities is obvious. But often it is not. In those cases, another good place to look is at how the definition of “financial responsibility” is handled.

Definitions of "Financial Responsibility"

For a gold star example of how “financial responsibility” is defined within the status quo personal finance bubble, let me to suggest this Investopedia article on "The Basics of Financial Responsibility."

Two key characteristics of the status quo definition of “financial responsibility” (exemplified perfectly in the Investopedia post linked above) are 1) that financial responsibility only requires a focus on you and your immediate dependents; and 2) that financial responsibility takes place in a de-contextualized silo.

What do I mean by a de-contextualized silo? I mean that “financial responsibility” in status quo personal finance does not require consideration of socioeconomic, historic, racial, gendered, geographic, or any other wider systems of power and privilege that structure how "financial responsibility" might look different for different people depending on their context within these systems.

Similarly, the status quo definition of “financial responsibility” does not require consideration of the impacts of personal financial decisions on anything outside of an individual silo. From the status quo perspective, it is perfectly logical that a person can be "financially responsible" while ignoring any environmental, socioeconomic, or other eco-system impacts that their financial choices might have on the wider world.

If there was any question on that last point, the Investopedia definition of financial responsibility makes it strikingly clear. In a section that purports to be about how financial responsibility is “a very personal definition" (reproduced in its entirety below, as of Jan 2023), Investopedia states:

“Does being financially responsible mean that you have to scrimp and save? Maybe, but only if that is what it takes to stay out of debt. On the other hand, if you are the Sultan of Brunei, you may easily be able to afford a jet, a mega-yacht, a mansion in the South of France and a few palaces. Although those of us with lesser means might frown on this extravagance, it shouldn't be confused with a lack of financial responsibility. After all, there's nothing irresponsible about buying things you can afford to pay for.”

That's it. That's the entire section on how financial responsibility is "a very personal definition." You could not get a better example of the status quo mindset around what "financial responsibility" means!

You will know you are in the bubble of status quo personal finance if a description like the one above is considered perfectly "logical" and assumed to be just an objectively "factual" definition of "financial responsibility."

If, however, you find yourself in a place where the concept of “financial responsibility” is considered subjective and related to your personal context within broader historical, societal and ecological systems, there's a very good chance you are in the community-minded personal finance space.

In the community-minded personal finance space, the definition of “financial responsibility” is considered personal in much deeper ways than in status quo personal finance. Rather than assuming there is a fixed, "factual" definition of "financial responsibility," in the community-minded personal finance space, each person is assumed to have their own personal and context-specific perspective on what "financially responsibility" means to them. There is recognition that wider societal dynamics, communities, beliefs, histories, power structures, ecological contexts and so forth necessarily impact what “financial responsibility” will uniquely mean to each of us.

In the community-minded personal finance space, personal wellbeing still matters but so does collective wellbeing. Exactly where and how we draw the lines in cases where there is tension between personal and collective financial goals is an especially personal - and important - part of the definition of “responsibility” here.

While the definition of "financial responsibility" is assumed to be personal for each individual, a unifying characteristic of “responsibility” - financial and otherwise - in the community-minded space is that it is seen as encompassing more than just looking out for yourself. We are calling this category "community-minded" after all!

Fragility and Defensiveness vs. Openness and Curiosity

The large size of the community-minded personal finance box on my diagram is not indicative of the size or loudness of information here (the status quo personal finance space is considerably louder!). Instead, the size of the community-minded personal finance area on my diagram represents the fact that, unlike the status quo finance bubble where there is one dominant defining worldview, in the community-minded personal finance space there is room for many worldviews.

I'd suggest that the reliance on one dominant defining economic worldview within the status quo personal finance bubble leads to characteristics of fragility and defensiveness.

In her powerful book, Indigenomics, Indigenomics Institute CEO, Carol Anne Hilton, highlights the fragility of the “descending economy” worldview. Hilton interviews Indigenous scholar, Dara Kelly, who points out that the dominant Western economic worldview is "a system that has built in its own justifications for its own existence.” Kelly goes on to explain:

“If you present alongside that existence other systems of resilience and other ways of being and knowing then that is a threat to the existence of the descending economy itself because it is actually so fragile. It has to dominate such a big space and it has for so long that it can’t afford to make space for other paradigms because other paradigms challenge its very existence in the first place.” (Dara Kelly quoted in Indigenomics by Carol Anne Hilton p.37)

In other words, the current dominant status quo economic worldview may be big. But it is also fragile.

And, hand and in hand with fragility comes... defensiveness.

I bring this up in the context of personal finance to suggest that, if you start poking around trying to uncover the logic and motivations underlying certain financial advice or ideas or products or services, and you are met with defensiveness, then this is a good clue that you are in the status quo finance bubble.

In the community-minded finance space, the whole point is that it is a space that is open to many worldviews, specifically those that include a consideration of collective wellbeing. If you ask questions around underlying logic or motivations and are met with openness to discussing this topic and curiosity around your own worldview, this is a good sign that you are in the community-minded finance space.

Is It Really an Either/Or Kind of Thing?

Can you really say that any given personal finance thing or person or perspective or organization is surely either in the status quo personal finance category or in the community-minded personal finance category? Is it really an either/or kind of thing?

Definitely not!

Especially if we are talking about people - like a specific financial advisor or your opinionated family member or whomever - it is fully possible that a person could be coming from a status quo personal finance perspective one day and then shift to community-minded personal finance perspective the next. Or, for example, a single book or website about personal finance could include some topics that take a fully status quo personal finance worldview and some topics that take a community-minded worldview. Similarly, each of us individually may have parts of ourselves, or times in our lives, where we feel our personal perspective on a specific topic fits either more in the status quo or more in the community-minded categories as I've defined them here.

This fluidity between the status quo and community-minded personal finance categories is totally part of it!

My point in offering these definitions is to provide one tool to help us navigate and understand the personal finance landscape. But, it's very important we recognize that that landscape is constantly shifting.

And, if you're like me, you welcome that shift!

Coming Up

Are you now wondering...

...What are some resources for financial advice in the community-minded personal finance space? What, if any, are areas where community-minded and status quo personal finance are similar (why did you draw the fields as overlapping)? What are the biggest areas where they are different? What does this mean for those of us interested in applying a community-minded lens to our own personal financial lives?

Well, I’m glad you asked. These are exactly the topics I will be addressing in the rest of this series on community-minded personal finance! I hope you will stay tuned.

Thanks for reading! Here are some resources that influenced my thinking in this article:

Note: The Ego-System to Eco-System framework is under a Creative Commons License by the Presencing Institute - Otto Scharmer

Find more of my favorite resources here.

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.