The Finance Matrix and TBD Finance

I've recently had several "ah ha" moments in my thinking about current trends in finance. This article is my attempt to share some of this thinking in an organized way. If you, like me, are interested in whether and to what extent we can "use finance for good," my hope is that you will find the framework I propose here helpful - or at least thought-provoking!

Setting Up a Matrix for Understanding Finance Trends

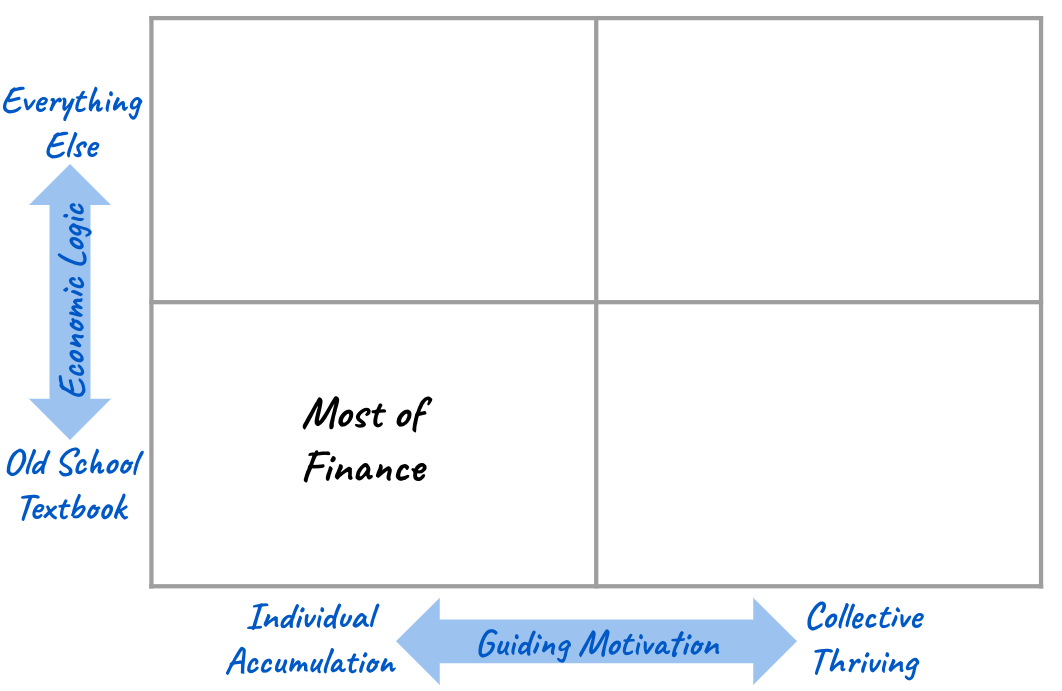

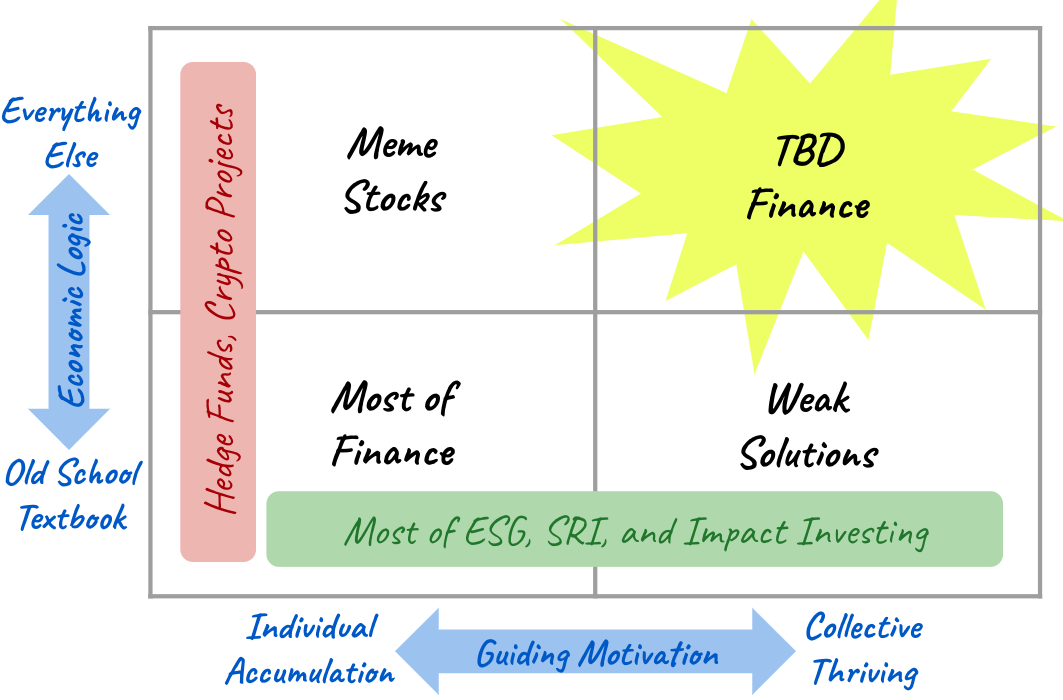

Let's imagine the field of finance as fitting within a two dimensional matrix.

On the horizontal dimension of the matrix is "guiding motivation." It looks like this:

On this dimension we ask, what is the primary motivation that guides your use of finance? Are you motivated to achieve individual capital accumulation (left-hand side) or to pursue collective thriving (right-hand side) or do you sit somewhere else along this continuum?

I think this "guiding motivation" continuum makes intuitive sense to most people. But, I recognize that some people hold the perspective that, in fact, the best path to collective thriving is for each individual to be guided purely by motivations of self-interest (which are assumed to be motivations of individual capital accumulation). People with this perspective would fall squarely on the left-hand side of this continuum. On the right-hand side, we would find those who consider a motivation for collective thriving as a valid guiding motivation in and of itself.

Can we debate this continuum ad nauseam? Absolutely. That’s kind of my point, as you will see. For now, let’s move to the next side of the matrix.

On the vertical dimension of our finance matrix we ask, what is your economic logic? Specifically, what are your underlying assumptions (whether conscious or subconscious) about how the economy works?

This dimension is slightly more challenging to think about because it asks us to consider our worldviews about what our economy is and how our economy works. There is A LOT of literature out there on this topic, but it is prone to jargon which I am trying to avoid here. For our purposes, let’s think of one side of this economic logic dimension as “old school textbook” logic and the other side as "everything else," like this:

I define "old school textbook" economic logic as that which is typically taught in traditional Econ 101 courses: rational man, supply and demand, equilibrium, etc. Core features of this logic include: 1) seeing the economy as an accumulation of many individual decisions made by rational, utility-maximizing, autonomous individuals with calculators in their heads; and 2) the concept that price determines value and value determines price.

For my purposes here, however, the most important feature of old school textbook economic logic - what truly sets it apart from "everything else" - is the idea that there are certain forces that are laws of economics, that are objectively true and unchangeable, similar to laws of physics. The law of supply and demand, the law of price equals value, the law of diminishing marginal utility, and so forth.

On the other side of the economic logic dimension, we have “everything else.” Now, I know this seems like quite a broad and undefinable category, but there are some reasons for looking at it this way.

First, old school text book economic logic is so pervasive, so deep, so widely accepted and so often completely unexamined in the world of finance, that even lumping everything else that is not this together does not come close to “balancing out” the dominance of old school textbook economic thought in our world today.

Second, as I alluded to above, I'd propose that there is a unifying feature to this "everything else" side of the economic logic dimension. Economic logic here rejects the belief that economies are structured by objective laws. On this side, there is a view that economies are created by people based on what they believe about economics and human nature. Logic here assumes nothing is fixed in stone about economics, but rather economics is based on the stories we humans tell ourselves about who we are. This is not to say that the dynamics of our economy are not “real” and cannot be observed and studied (many thinkers on this side are very interested in empirically studying how our economy actually works). Rather, the distinguishing feature of this side of the economic logic dimension is an assumption that the reality of our economy is constructed by us - people - based on what we believe, not based on external objective laws.

Considering the "Most of Finance" Box

Now, let's begin to fill in this matrix:

In the bottom left corner we have "Most of Finance." In this quadrant we find enormous sums of money, deeply embedded institutions, and the often completely unconscious, "just common sense" thinking of most of the finance profession.

In fact, some would say that by definition, this bottom left-hand quadrant is simply what finance is. Anything else might involve money and people but it’s not “real” finance - it’s philanthropy or stupidity or something else, but not finance. I would reject that sentiment, but I would agree completely that this quadrant is the overwhelming center of gravity of finance.

Importantly, for many people who are sitting in this "Most of Finance" quadrant, no other conception of finance is possible. Many (most?) finance professionals, finance institutions, and financial intermediaries sit in this bottom left quadrant. This makes the gravitational pull of this quadrant extremely powerful.

What About ESG, SRI, and Impact Investing?

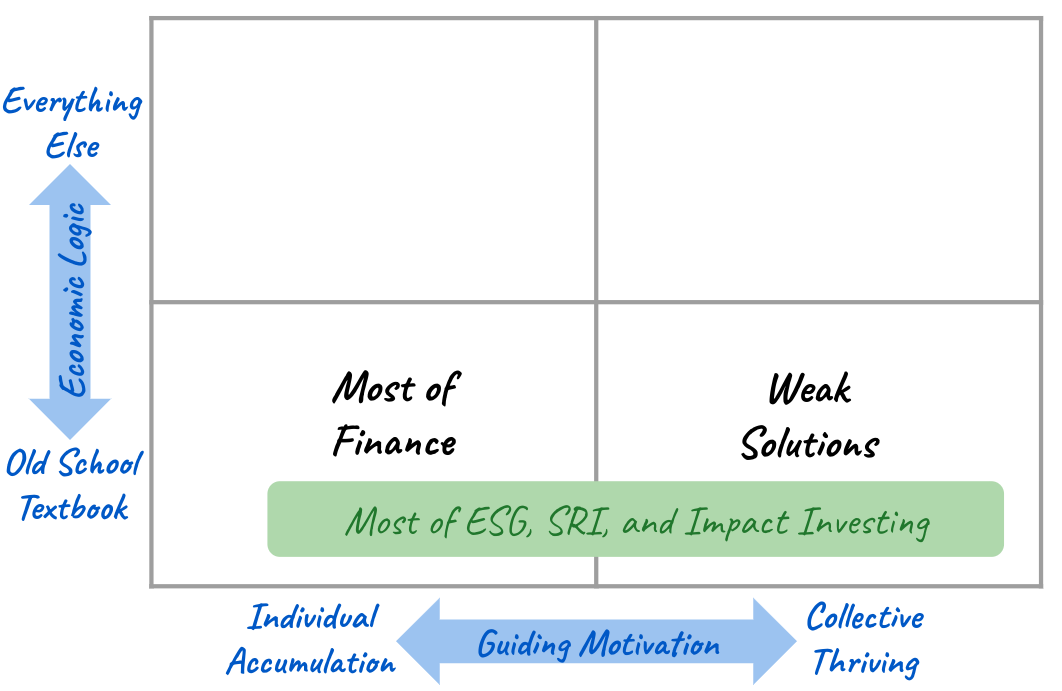

This gravitational pull of the "Most of Finance" box, in my opinion, is critical to understanding what has been happening with the field of socially responsible investing (SRI), Impact Investing, and ESG (investment strategies that consider "Environmental, Social, and Governance" factors along with financial return).

On paper, the trends in ESG, SRI, and Impact Investing should be some of the best news in a generation. In recent years, over 35 TRILLION dollars of assets have been allocated to ESG strategies, representing a full third of all assets under management in the world! This should be incredible news for the environmental, social, and governance well-being of our world! And yet.... well, you tell me? Have you noticed the impact?

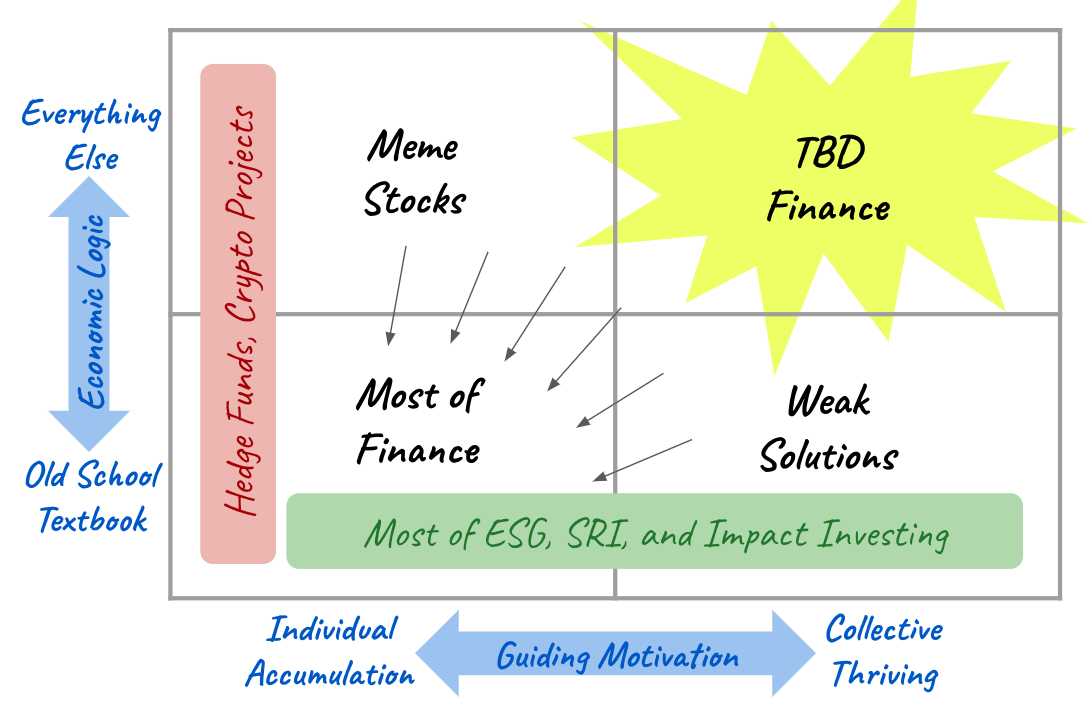

I would argue that the ESG, SRI, and Impact Investing trends we are currently seeing in finance can be represented on our matrix like this:

I am suggesting two key points with this depiction. First, it has become clear that much of the activity in ESG, SRI, and Impact Investing is "greenwashing" and is best placed in the bottom left quadrant of our matrix. Unfortunately, we have seen a phenomenon of so-called ESG and "Impact" approaches that, upon investigation, have been revealed to be no more than new marketing for the same old status quo approaches to finance. In these cases, players in the finance industry have opportunistically slapped an ESG label on already existing financial products and practices with no intention of changing the underlying strategies. The prevalence of this type of greenwashing in the ESG finance world is a clear example of the gravitational power of the "Most of Finance" quadrant.

The second point about ESG trends that I'm suggesting here is that there also are efforts that are genuinely guided by motivations related to "collective thriving," but these are limited by the fact that they are based on unexamined old school textbook economic assumptions. The result of simply putting a collective-thriving motivation on top of old school economic logic is that even truly well-intentioned SRI, ESG, and Impact Investing solutions have relatively minimal impact. The bottom right quadrant of our matrix is characterized by good intentions but bad theory which, unfortunately, leads to weak and ineffective solutions. This has helped make ESG an easy target for cynicism from both the political right and the political left, and there has been no shortage of that.

Why are ESG, SRI, and Impact Investing efforts still based on old school economic logic? One reason has to do with the academic field of finance and finance education generally. In the field of economics there are at least some academic circles that are debunking and offering alternatives to old school textbook economic logic. In the field of finance, however, there has not been a corollary academic reckoning with underlying old school textbook finance assumptions (which are still based on old school textbook economics assumptions).

The main parallel phenomenon in finance has been the emergence of SRI, ESG, and Impact Investing. But, any considerations of worldviews related to SRI, ESG, and Impact Investing are dominated by the debate about guiding motivation. That is, the dominate questions are around whether finance should even consider collective thriving or if it must be focused solely on individual accumulation. This is such a loud and contested debate in finance that it is as if there is no room left to have any awareness of - much less debate around - the vertical dimension on this diagram, the dimension of economic logic.

In other words, while there is an active academic field of heterodox economics (which is a jargony term for what I am simplistically calling "everything else" on my diagram), there is simply no such thing as "heterodox finance."

Or is there?

To that question, let me to propose a two word answer...

...meme stocks.

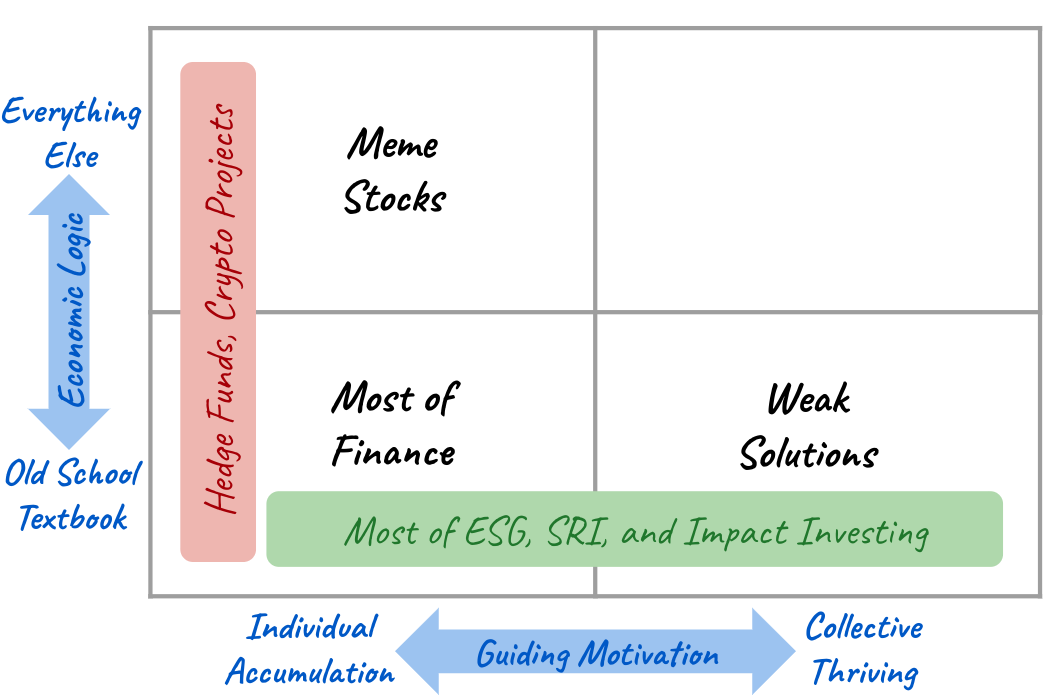

The Meme Stock Phenomenon

Whatever is happening or not happening in academic finance, there are certainly people out there doing a kind of finance that ignores old school economics and finance textbook views of the world. Certain hedge funds have been doing this for a long time, and arguably many crypto projects attempt to reject dominate textbook logic. But, if you ask me, meme stocks win the prize as THE quintessential example of the upper left-hand quadrant of our matrix.

Meme stocks are interesting because a huge part of their appeal, arguably their defining feature, is their conscious and intentional rejection of anything considered “fundamental” in economic and finance theory. Here's one way to think about how meme stock thinking works: "everything on paper, according to textbook theory, says GameStop should be worth $X per share because the present value of its future cash flows are worth $X per share because that is the law of finance. But, in fact, that's not actually a fixed law of nature, but rather it is a story that people tell about how the economy works. We, individual human GameStop investors, are going to intentionally tell a different story. We are going to tell a story where the value of this GameStop stock actually has nothing to do with future cash flows and instead has to do with how we feel about it. And, we are going to actively and purposefully mess with everyone who believes that so-called 'fundamental' laws of finance are objectively true."

Whatever you think about it, the meme stock phenomenon is some of the clearest evidence around of a movement rejecting old school economic and finance textbook logic! However, meme stocks are also unabashedly motivated by a focus on personal accumulation. This leads to the tendency toward Ponzi-scheme-ism and other concerning trends. So, beyond acknowledging the existence and activity of this quadrant, I prefer to keep my distance.

TBD Finance - the Whole Point of this Finance Matrix

And so, we finally get to ask: what, then, is in the top right quadrant of our matrix?!

The short answer to that question is: TBD.

[The longer answer is exactly what I will be exploring in my newsletter, so please consider signing up to learn more together with me!]

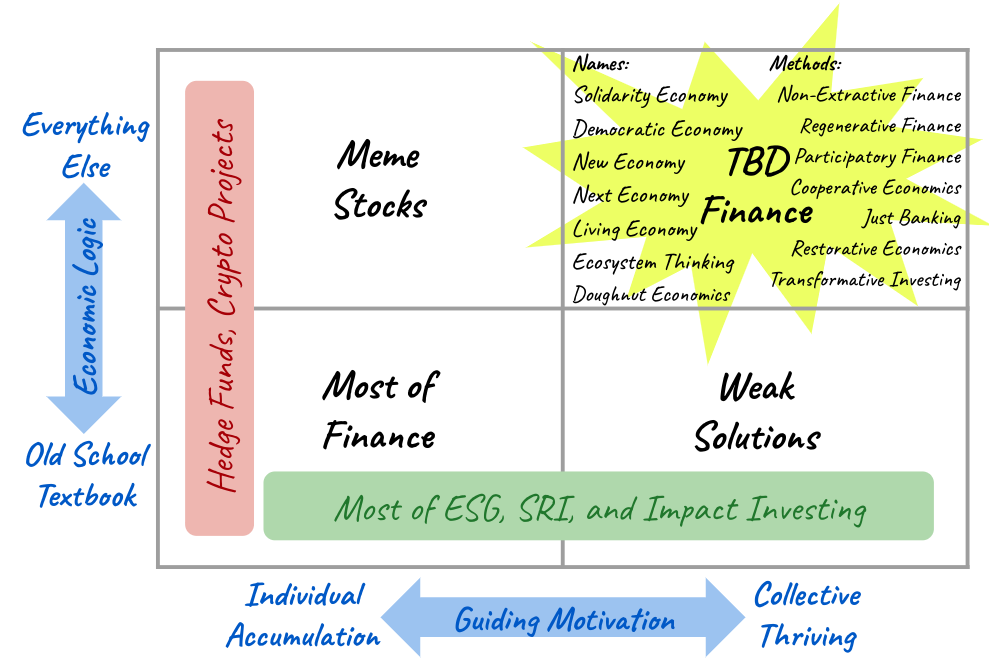

I'm calling the top right box of our finance matrix "TBD Finance." This is the quadrant where we find efforts that are trying to use finance in ways that are both motivated by collective thriving and reject old school textbook economic logic.

Personally, this is the quadrant that I am most interested in. In fact, this top right quadrant is my main reason for drawing this matrix in the first place.

Why am I so interested in this quadrant and why do I think it's important to consider it within a matrix like this? There are two key reasons - one cautionary, one celebratory - let me explain:

First, I am trying to caution that while many people may have a desire to use finance in a way that both supports collective thriving and rejects old school textbook economics, the desire alone is not enough to ensure that those people's financial resources end up in the top right quadrant. This is because the pull to the bottom left "Most of Finance" quadrant is powerfully strong and deeply entrenched in our financial institutions and in the minds of many finance professionals. We can visualize this pull with arrows like this:

In other words, those of us interested in moving resources to the top right quadrant will need to actively work against the gravitational pull to the bottom left if we are going to be successful.

[Want to explore how we do that? Me too. That is theme #1 of my newsletter.]

Second, I want to celebrate that, despite what you may have heard, this top right quadrant DOES EXIST. I’m here to tell you right now that there is actually PLENTY of action in the "TBD Finance" quadrant and there seems to be more every day. [Theme #2 of this newsletter will be to educate about and highlight examples of work already happening here.] I believe we need to pay attention to and amplify work being done in this quadrant because awareness of the existence of this quadrant - in and of itself - can help expand the worldview of those of us trapped in the "Most of Finance" box.

Take my own experience as an example. I have 2 masters degrees related to these topics - an MBA with a focus on Finance and Masters of Public Policy with a focus on Economics - and I have worked professionally in both Corporate and Nonprofit Finance. Even so, I was completely clueless about this "TBD Finance" quadrant until recently. In fact, if I were to base my awareness solely on what I was taught in my MBA, I would believe that this quadrant wasn’t even a possibility. Not only doesn’t it exist but it is not possible to exist. That is how the world looks from the "Most of Finance" view, and that is where most business and finance education resides.

But that view is simply wrong.

In fact, there is so much going on in this top right quadrant that there are MANY names for it. And, there are MANY methods for engaging in finance in this area that are already in practice.

I've added some examples of these names and methods here:

I'm calling this box "TBD Finance" just for the purposes of this diagram because I want to emphasize that it really is to be determined. It is being determined collectively by those who are showing up here. And, by its very nature, it will always be a space where more is waiting to be determined - by all of us.

Some Concluding Thoughts

For those of us interested in transformational economic change, it is not enough to just push the field of finance to be motivated by more than individual capital accumulation. We also need to see and then reject the underlying economic and financial logics that are not serving us well.

If the stories behind our economic worldviews are leading us down a road we don't want to be on, a road that is destroying our human and natural world, we should choose to tell different ones. If we do not, we will have solutions that are weak at best and corrupted and co-opted at worst. And, we definitely will not have transformational change.

I believe we need to update our underlying assumptions about finance and our economy if we are going to have hope for the long-term survival of our human and natural ecosystems. Updating our underlying assumptions cannot be done without first seeing the ways our old assumptions control us. Today, the field of finance may seem very far from doing this. But I believe change is coming. At least, that’s the story I’m choosing to tell. I invite you to join me.

Thanks for reading! Here are some of the key resources that influenced my thinking for this article...

...and there are many more! In fact, basically everything I've compiled on my Resources Page here has relevance to this article and has influenced my thinking. Check it out if you're interested.