Personal Finance Steps and Mind Control

My posts in this newsletter so far have mostly focused on introducing some bigger picture frameworks for thinking about finance in our lives. For the next few articles, I’m going to try to move a few layers deeper to explore more of the “so whats” and “how tos” of community-minded personal finance.

In this post, I look at the steps that are generally considered part of a personal finance "journey." I explore how these steps may or may not look different when taking a community-minded personal finance approach. What do I find to be the biggest difference of all? Oh, just the simple matter of mind control.

This is article #4 in my series on community-minded personal finance. Here are articles #1, #2, and #3 in that series.

Typical Personal Finance Steps

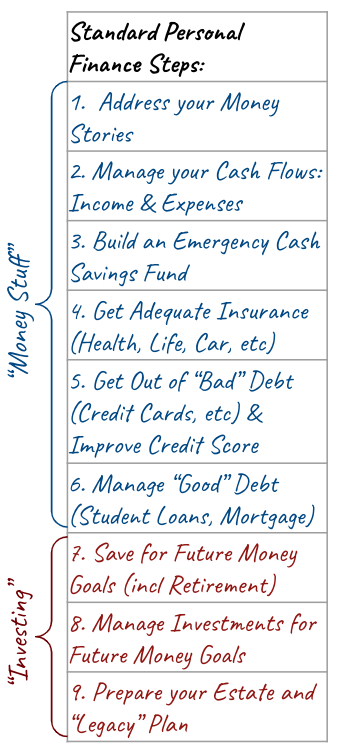

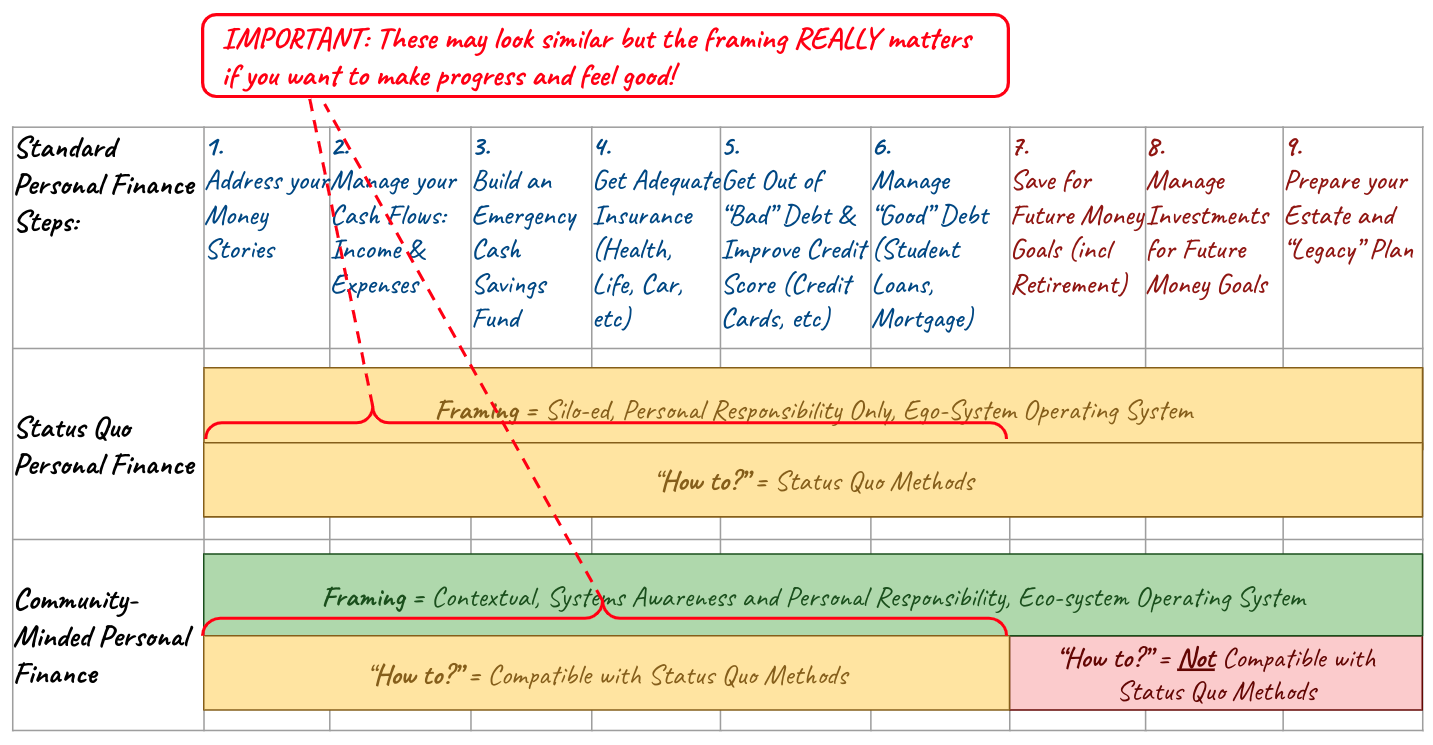

There are some standard personal finance steps that you will find - in one version or another - in almost all personal finance “how to” resources. These steps look something like this:

Does doing community-minded personal finance mean you don’t have to do these steps? Unfortunately, no. Not in the world we live in today. So we may as well talk about them.

First, let me acknowledge that although I have presented these steps in a linear way, this is misleading. Depending on your situation, the best order for you to approach these may look very different. And, “steps” is a deceptive term because it makes it seem like once you've taken care of each of these topics you’re “done” and you move forward. In fact, these are all topics that typically need to be addressed in an ongoing way throughout our lives. Not to mention that how we can address each of these steps will be personal and unique depending on our individual circumstances and the circumstances of our immediate community.

In other words, while I have represented these "standard personal finance steps" as if they are simple and straight-forward, the reality is that they are pretty much the opposite of simple and straight-forward for most of us.

Even so, when you hear someone talk about a "personal finance journey” - whether they are coming from a status-quo or a community-minded perspective - this is the general roadmap that they likely have in mind.

How are Community-Minded Personal Finance Steps Different?

I’m going to use these standard personal finance steps as a starting point to explore the question: how do we do personal finance differently if we are taking a community-minded approach?

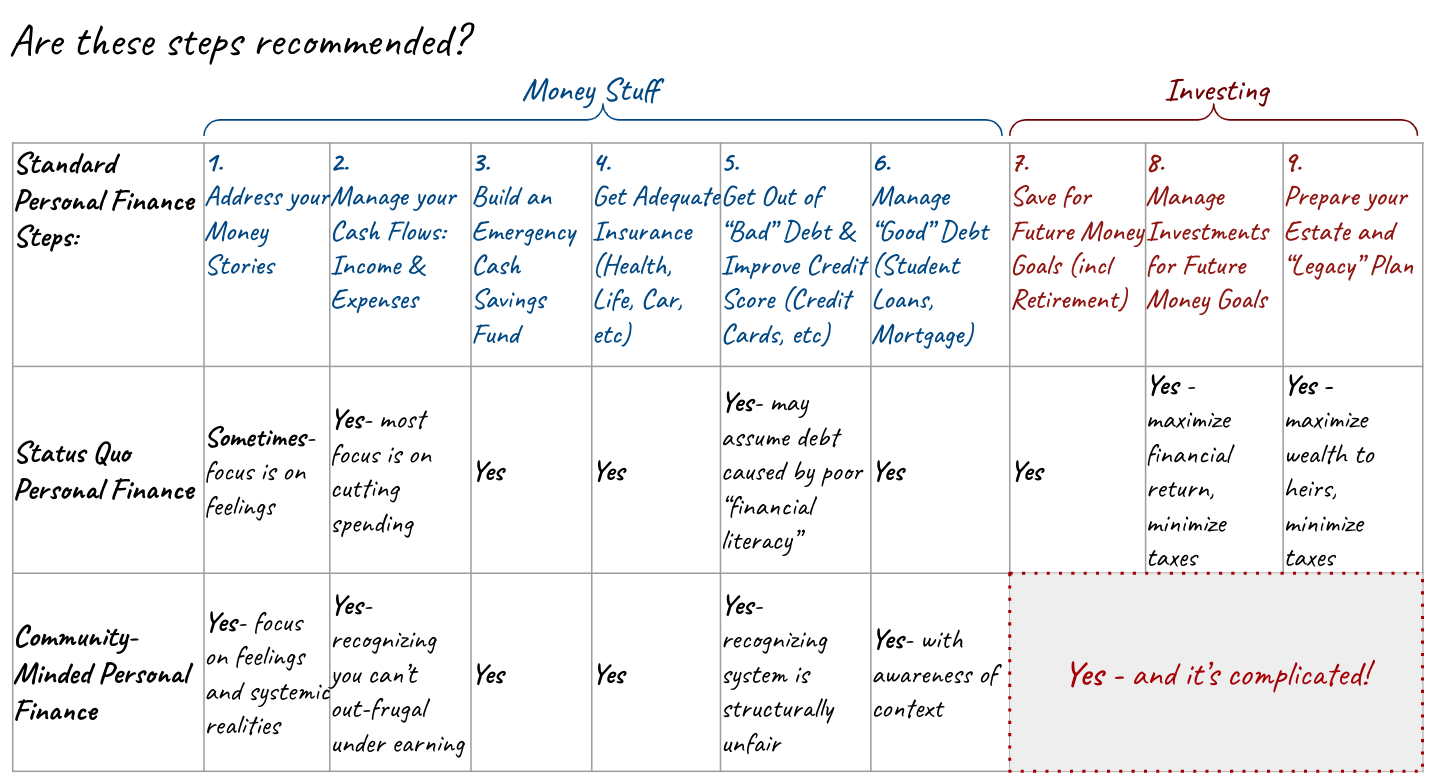

Here’s my summary of what I think the key differences are for each step:

This is actually not a place where I plan to go into detail on each of these steps. This has been done extremely well elsewhere and I will share links at the end of this post if that is what you are looking for.

Instead, I’d like to focus on three key points that are suggested in the above summary table. These are:

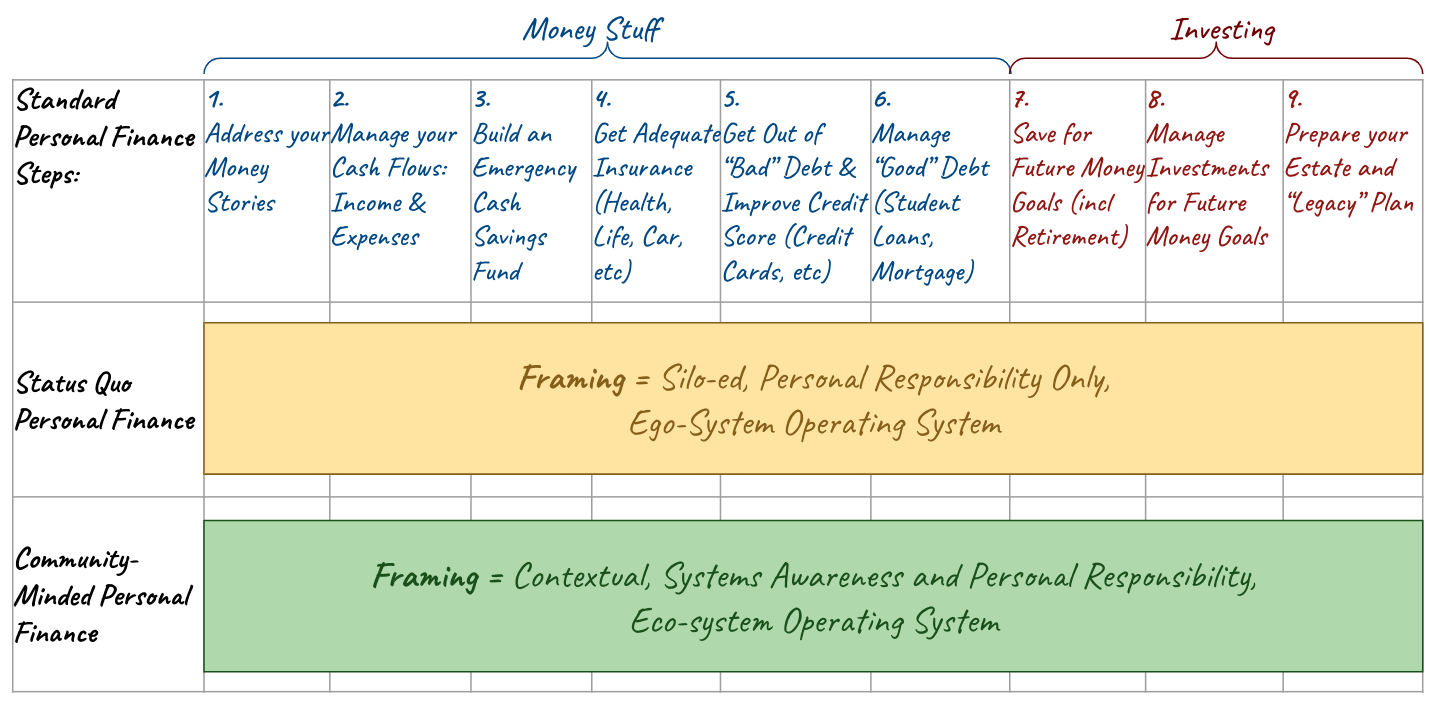

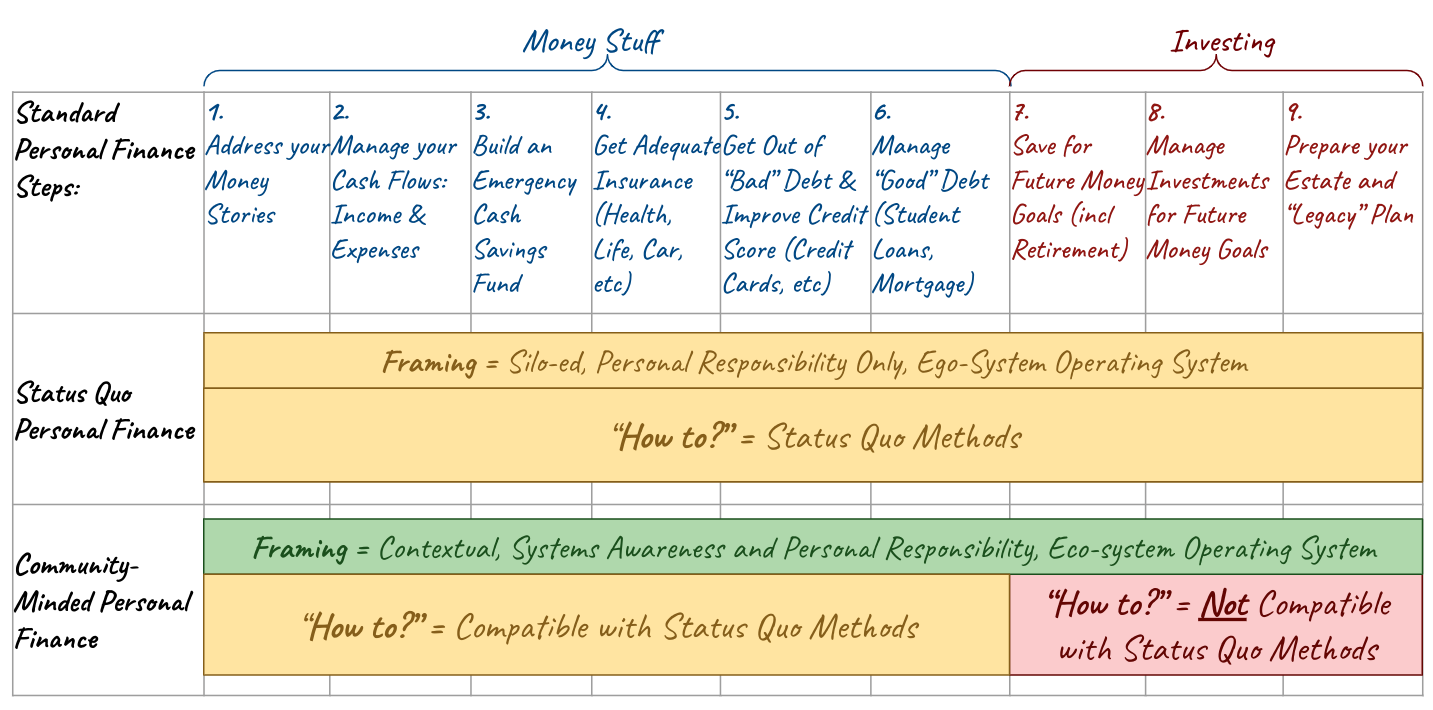

1) That the personal finance steps we need to address are similar whether we are taking a community-minded or status quo approach, but what’s really different is the framing.

2) That the framing really matters, particularly because status quo framing can lead to a false diagnosis of the challenges we face in personal finance (a.k.a. gaslighting), especially in the "Money Stuff" steps 1-6.

3) That, when taking a community-minded approach to personal finance, the "Investing" steps 7-9 are uniquely complicated (I will suggest, in fact, that they are complicated in a way that has a lot to do with mind control).

Let’s take a closer look at each of these points.

The steps may be similar but the framing is different

Although community-minded personal finance practitioners would likely agree with status quo practitioners that each of the standard personal finance steps are important, the framing is very different across approaches. We can think of these differences like this:

As shown, a big theme that distinguishes community-minded personal finance from status quo personal finance is systems awareness. Community-minded personal finance includes an understanding of contexts - particularly contexts related to systems of wealth and income inequality - that shape the terrain differently for different people. People who take a community-minded approach to personal finance are also aware that their decisions impact social and environmental ecosystems beyond their individual silos (what may be called “eco-system” awareness).

Does this different framing suggest we should use entirely different methods for dealing with each of these standard personal finance steps when taking a community-minded approach?

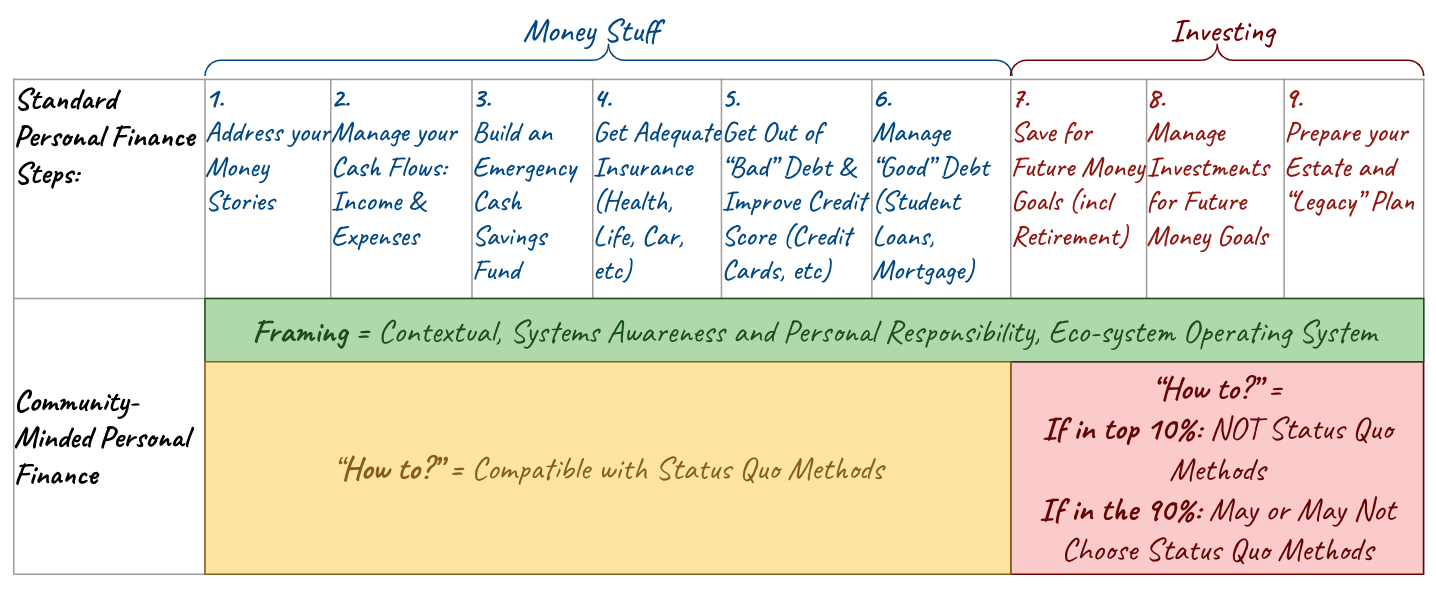

Yes and no. This is where I think the distinction between "money stuff" steps and "investing" steps comes in.

Steps 1-6, what I'm calling "money stuff steps," are the personal finance topics that people often have in mind when they say things like "I'm getting my financial life under control." These steps include managing cash flows (budgets), building an emergency savings, managing debt, and getting necessary insurance. I would argue that the methods - the actual actions you will ultimately take to deal with these first six "money stuff" steps- are relatively similar whether you're taking a status-quo or a community-minded approach. This is because, generally speaking, status quo objectives for these steps are compatible with community-minded objectives (I’ve explored this point related to building a cash savings here).

However, in contrast to the money stuff steps, for the investing steps 7-9 (long-term saving, investing, and estate planning) community-minded objectives are arguably fundamentally incompatible with current status quo approaches to personal finance. This is largely because a motivation for individual capital accumulation without eco-system awareness is built into the core DNA of status-quo finance and investing today. This is a point I’ve attempted to make clear previously here and here, and will be coming back to at the end of this article.

The framing really matters

Since the actions we take in the money stuff steps 1-6 may be similar whether we are taking a status quo or community-minded approach, does this mean that the differences in framing between these approaches doesn't matter? Definitely not!

Why are these framing differences so important? Well, put simply, because one approach (status quo) will gaslight you as you go through these steps and one approach (community-minded) will not.

We don't need to look further than this Investopedia article on "What is Personal Finance" for an example of the gaslighty, silo-ed, personal-responsibility-only framing that pervades status quo personal finance. Under the header of “The Importance of Personal Finance,” the authors of this article unironically list recent increases in total American debt - including credit card debt, mortgage debt and student debt - as evidence of how “not understanding how to manage finances or be financially disciplined has led Americans to accumulate enormous debt.”

I don't know about you, but I can think of many reasons why total American debt may be increasing, and people “not being financially disciplined,” is not high on my list! I’m tempted to laugh at the ridiculousness of this framing but, I also know it’s not really a laughing matter. These levels of debt reflect a reality where millions of people in the U.S. feel that they have no other choice but to borrow in order to address basic needs for themselves and their families.

Saying that individuals are personally to blame for the systemic realities of our current economy is not only misguided, this type of framing itself adds yet another barrier for people trying to make progress in addressing their "money stuff." As Dana Miranda points out in her critique of budget culture, the biggest problem with status quo approaches to things like budgeting is that they just don't work.

The good news is that there really are people and organizations out there providing systems-aware support and resources for tackling our "money stuff" personal finance steps. I have some examples listed at the end of this article that I hope you will check out. I want to make sure you know that community-minded resources for these steps really do exist. If you’ve read this far, I know you recognize that our personal decisions and options are deeply shaped by our socioeconomic, historic, racial, gendered and other systemic contexts. If you happen to be looking for support in getting your money stuff under control, don’t settle for personal finance resources that do not take this (obvious) reality into account!

Some Uniquely Complicated Steps in Community-Minded Personal Finance

We enter another ball game of complexity when it comes to the personal finance steps I've listed as 7-9, the steps related to saving and investing for the future.

Why are these steps so complex when taking a community-minded personal finance approach?

Well, because saving and investing involves putting your money into our finance system. And, baked in at almost every level of our finance system today is an assumption that individual accumulation must be the primary motivation of finance, without regard for collective thriving (this "baked into finance" problem is the whole premise of this newsletter, but was especially a focus of my first article here).

To begin to discuss what this means on a personal level, we need to start by acknowledging that investing with a community-minded lens is fundamentally different if you are coming from the top 10% or the bottom 90% of wealth holders (a distinction discussed at length in my last post here).

Specifically, I want to acknowledge that there is a case to make that if you are coming from the bottom 90% of wealth holders, you may choose to use status quo methods for investing and still consider yourself to be taking a community-minded approach. This is because it is mathematically true that if a meaningful number of people in the 90% are able to increase their wealth, this would change the structure of wealth distribution in the U.S. in the direction of decreased inequality. And decreased wealth inequality is certainly a critical component of collective thriving.

However, this logic does not hold for people interested in taking a community-minded approach to investing who are in the top 10% hockey stick. For this group, the opposite is true. If a meaningful number of households in the top 10% increase their wealth, this will tilt the structure of U.S. wealth distribution in the direction of even further inequality (this is, in fact, the trend we’ve been seeing in recent decades).

It's important here not to be deceived by the numbers and assume that "the 90%" represents the larger share when it comes to investing. Unfortunately, wealth distribution is so drastically skewed in the U.S. that this is not the case. The bottom 90% of wealth holders in the U.S. own only 32% of the wealth in the country.

Put another way, the top 10% wealth holders together control more than two thirds of the wealth and therefore presumably own more than two thirds of the investments (by $ value) owned by the entire American population.

It is convenient for the status quo finance industry to pretend that everyone's investing decisions are more or less equal. But, nothing could be further from reality. Still, they just go on pretending. Why? Because this is a very useful story to tell us to control our minds.

One of the biggest benefits of pretending that everyone's personal investing decisions are more or less equal is that it justifies the logic that all investments have to prioritize maximizing financial return, relative to risks taken, because this is simply what investing is. Not only is this what investing is, but there is a moral case for it to be this way so that "regular people's investments" can grow so that they can take care of their personal and family financial futures. My point is that, while I will grant that this logic might make sense for the bottom 90% of wealth holders, it just does not hold for the top 10% who control 68% of the wealth in the U.S. today.

If we can free our minds from the story that it is morally good and right for all people's investments to prioritize maximizing financial return - that this somehow is good for "regular people" despite the realities of how wealth is currently distributed in the U.S - then we can see that, if you are in the top 10%, investing methods that are based primarily on maximizing financial return are fundamentally incompatible with a community-minded approach to personal finance.

Since maximizing financial return is so deeply ingrained in our current status quo approaches to finance, I believe people in the top 10% who truly want to invest in "making the world a better place" need to throw out the status quo investing playbook entirely and take a completely new approach to investing. They cannot rely on the old playbook that most finance professionals have been trained in and that most finance systems are set up to support. This is why it's so complicated!

And that's for the top 10%. If you are in the 90%, and are interested in investing outside of the status quo for community-minded reasons, I would argue it’s even MORE complicated! Investing differently from the status quo is inherently risky and, if you're in the 90%, you're exposed to an entirely different level of risk (more material to your basic needs) than the top 10%.

The truth is, saving and investing outside of the status quo is an area that is risky and complicated for everyone. And there’s no road map. And there're no “right” answers. There are just personal judgements amid complexity and uncertainty. And yet, saving and investing outside of the status quo is also an area that is all about believing in and working towards a future that is better than our present, a future that is better for everyone - for the full 100%.

This complexity and uncertainty, but also this connection to a dream of a future that is better for everyone, is why I’m personally obsessed with this topic. This is also why I will be spending the rest of this series diving further into saving and investing from a community-minded lens. I hope you will stay along for the ride.

Examples of Community-Minded Framing of Personal Finance Steps

I've said it before and I'll say it again, Paco de Leon's book, Finance for the People, is an excellent place to start for a systems-aware guide through the personal finance steps.

And, for a truly extraordinary collection of personal finance resources, all with a community-minded lens, you must check out Hadassah Damien's content over at ridefreefearlessmoney.com. For example, here's Hadassah's awesome (much more user-friendly than mine) guide to money steps.

Another source of fantastic resources in the community-minded personal finance space is the content Dana Miranda has put together at healthyrich.co. As I mentioned, her critique of budget culture is exactly what I'm talking about when I say framing really matters!

If you are looking for a community of support as you tackle your own personal finance steps, a wonderful option is Diana Yañez's Bosque Money Community Coaching program. I just had the opportunity to attend a Q&A Diana did about this program and I was so moved by the gentle and empowering presence she brings to virtual community spaces. Diana is definitely an embodied example of what I consider a community-minded personal finance practitioner.

In fact, I'm part of a whole network of financial advisors, money coaches, and other financial professionals that do work that falls in the category of community-minded personal finance as I've described it in these pages. The network is called "Radical Financial Planners" and, while there is not currently an online presence, I promise you it is still quite real and full of incredible people. If you are looking for help with something specific on your personal finance journey and struggling to find support from a community-minded lens, please feel free to be in touch with me. I'd be happy to help connect you to a person or resource that could be a good fit.

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.